Bitcoin Magazine

How The IMF Prevents Global Bitcoin Adoption (And Why They Do It)

The Global Pattern

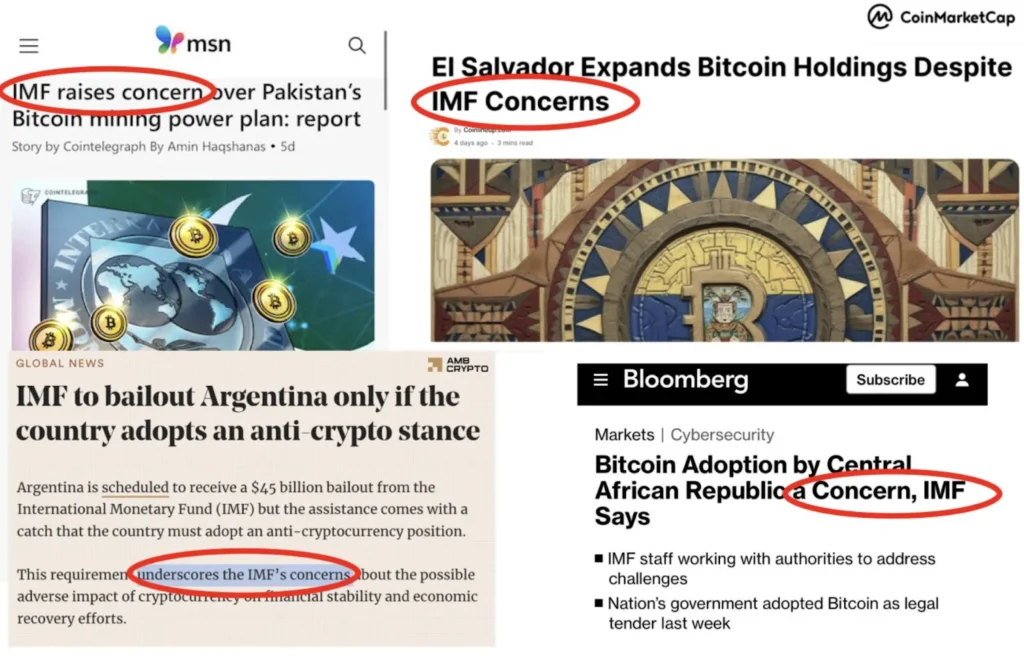

In recent years the IMF has:

- Successfully pressured El Salvador to (de facto) drop Bitcoin as legal tender, and rollback other Bitcoin policies

- Successfully pressured CAR’s 2023 Bitcoin repeal through regional banking bodies

- Been responsible for the lack of follow through from Bitcoin campaign rhetoric to action from Milei in Argentina.

- Cited “serious concerns” with Pakistan’s Bitcoin plans

- Consistently framed crypto as a “risk” in loan negotiations

Here’s a summary

| Country | GDP ($ Billion) | IMF Loan ($ Billion) | IMF Loan as % of GDP | IMF response | Result |

| Argentina | 670 | 54.8 | 8.18% | strong | Bitcoin policy abandoned |

| Central African Republic | 2.56 | 0.272 | 2.31% | strong | Bitcoin policy abandoned |

| El Salvador 2.0 (post-2025) | 34.87 | 1.4 | 4.01% | strong | 5 Bitcoin laws abandoned |

| Pakistan | 346.79 | 9.35 | 2.70% | strong | TBD |

| El Salvador 1.0 (2021-2024) | 34.87 | 0 | 0% | strong | Bitcoin maintained |

| Bhutan | 2.9 | 0 | 0% | mild | Bitcoin maintained |

As we can see, the only nations that were able to resist IMF pressure were El Salvador, prior to gaining an IMF loan, and Bhutan which does not have an IMF loan.

Each country with an IMF loan who has adopted, or attempted to adopt Bitcoin at a nation-state level has been successfully thwarted, or largely thwarted by the IMF.

How is it that the IMF has been so successful in preventing global nation state adoption, with the exception of Bhutan, and why do they aggressively move to prevent it?

In this detailed report we do a deep-dive into each of the three nations where the IMF has successfully pushed back against Bitcoin adoption, and the signs that it is likely to be successful achieving the same result with Pakistan.

In the last section of this report, we look at the IMFs five reasons to fear Bitcoin, and how Bitcoin is still thriving from a grassroots level despite top-down Bitcoin abandonment, or partial abandonment, by various nation states.

1. Central African Republic: When Colonial Money Met Digital Hope

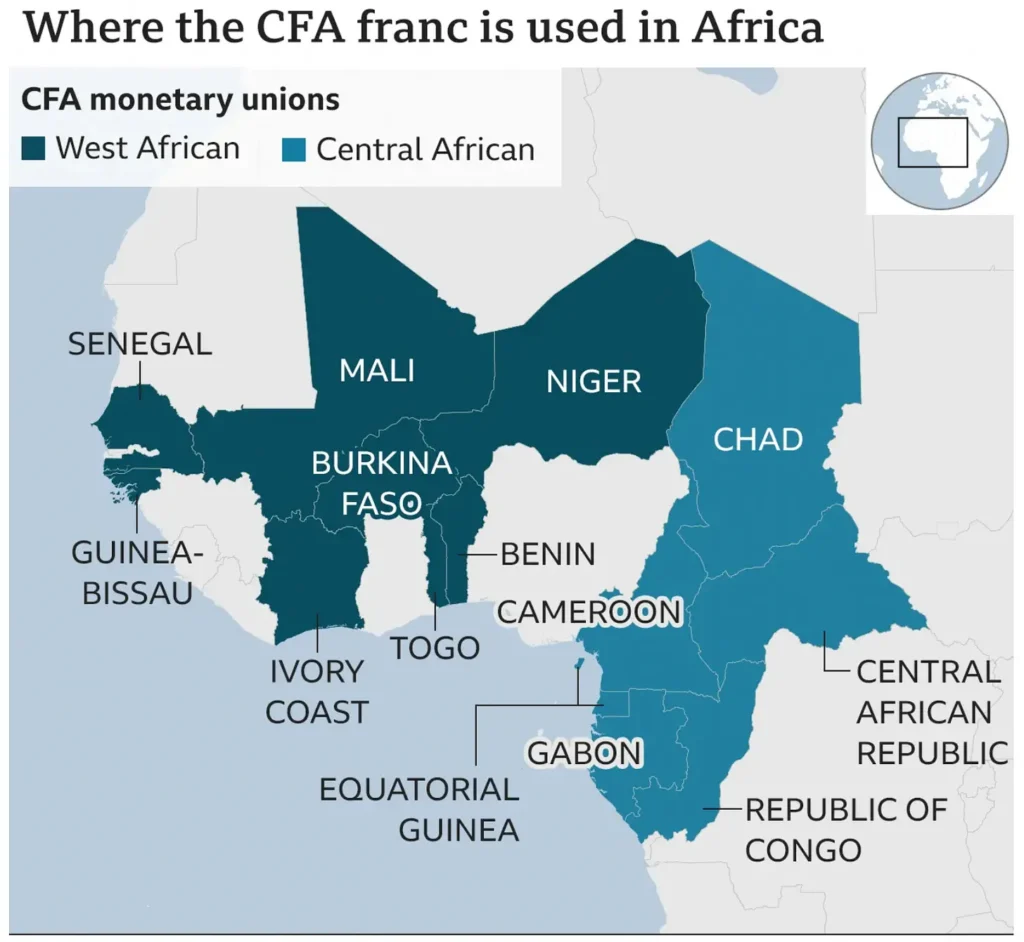

The Central African Republic (CAR) uses the CFA franc. The CFA isn’t just currency—it’s a geopolitical chain, backed by France and governed by the Bank of Central African States (BEAC). Of its 14 member nations, the 6 Central African nations (including CAR) must still deposit 50% of foreign reserves in Paris.

This control over reserves fosters economic dependency, while establishing export markets for French goods at favorable terms. In 1994 for example, the CFA was devalued by half, a policy that was influenced by Western pressure, particularly from the IMF. This caused the cost of imports to leap, leading to exporters (mainly EU based) being able to procure resources from CFA nations at half the cost. Locally the impact was devastating, leading to wage freezes, layoffs, and widespread social unrest across CFA countries.

When the Central African Republic (CAR) announced in 2022 it was adopting Bitcoin as legal tender, BEAC and its regulatory arm COBAC immediately voided the law, citing violations of the CEMAC Treaty; The treaty which established the economic and monetary community of Central Africa. This wasn’t bureaucracy—it was a warning shot from the monetary guardians of la Françafrique.

Why it mattered: To this day, CAR’s economy relies heavily on IMF bailouts. With $1.7Billion in external debt (61% of GDP), defying BEAC meant risking financial isolation.

The IMF’s Silent Campaign

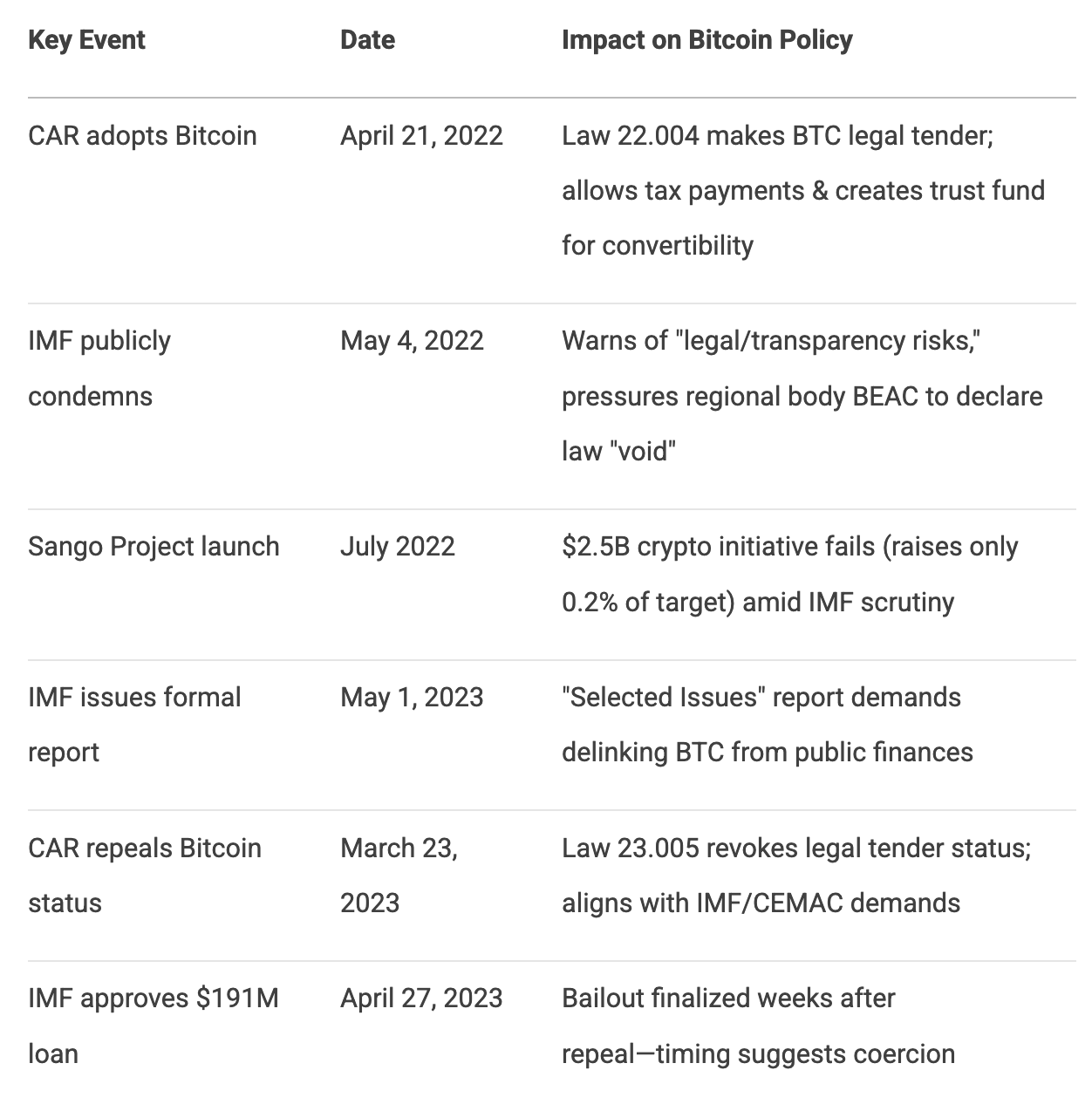

The IMF moved fast. Within two weeks (May 4, 2022), it publicly condemned CAR’s “risky experiment,” citing legal contradictions with CEMAC’s crypto ban. The move raised “major legal, transparency, and economic policy challenges,” the IMF said, that were similar to the concerns the IMF raised about El Salvador’s Bitcoin adoption: risks to financial stability, consumer protection, and fiscal liabilities. (For context, none of those risks materialized in El Salvador).

But their real weapon was leverage. As CAR’s largest creditor, the IMF tied its new Extended Credit Facility (ECF)—a $191M lifeline—to policy compliance.

The Timeline That Tells All

This table traces the IMF’s shadow campaign:

Key to scuttling CAR’s Bitcoin ambitions was ensuring that the Sango project — a blockchain-hub initiative from the CAR government to sell “e-residency” and citizenship for $60K in Bitcoin — did not proceed.

The Sango Project – coincidence or collusion?

In July 2022, CAR launched the Sango Project. It aimed to raise $2.5B (100% of GDP).

It failed catastrophically. By January 2023, only $2M (0.2% of target) was raised. While IMF reports cite “Technical obstacles with 10% internet penetration” as the reason for the failure, our analysis shows a different picture. Two factors scuttled the project.

- Investor flight

- A CAR Supreme Court ruling formally blocked the Sango project

However, on closer examination, both of these factors hint at IMF involvement.

Let’s take a closer look at the evidence.

Investor Flight

The IMF’s role in this investor flight is circumstantial but compelling. On May 4, 2022, the IMF expressed concerns about CAR’s bitcoin adoption, stating it raised major legal, transparency, and economic policy challenges. This statement, made before the Sango Project launch, highlighted risks to financial stability and regional economic integration, potentially deterring investors. Further, in July 2022, during a staff visit for the Staff-Monitored Program (SMP) review, the IMF noted “economic downturns due to rising food and fuel prices”, which could have compounded investor caution. Reports also mention that the IMF and COBAC warned of inherent risks in CAR’s crypto move, adding to the skepticism.

The timing of these IMF statements aligns with the observed investor flight, suggesting that their cautionary stance may have influenced perceptions. While circumstantial, the sequence of events suggests IMF influence as a respected financial institution in the investor community likely played a role in investor flight.

Supreme Court Ruling

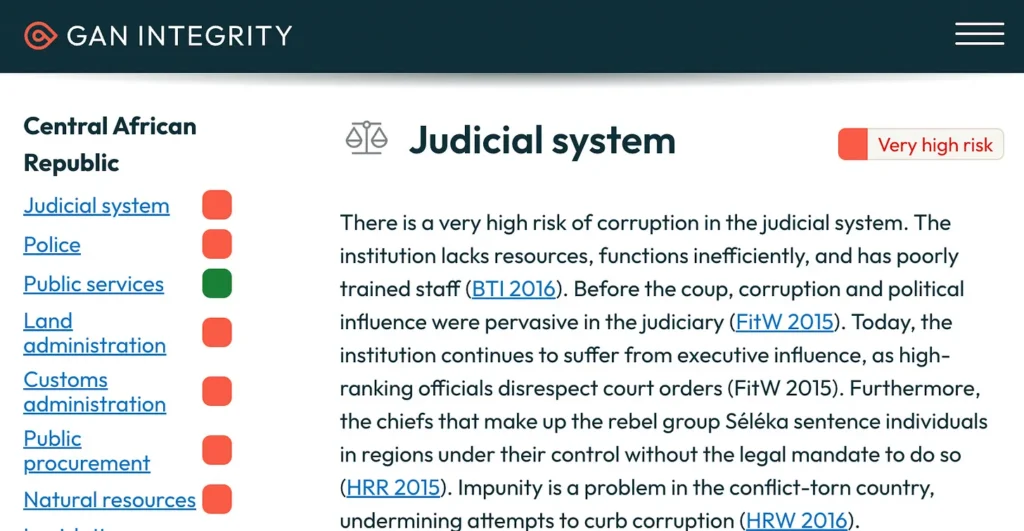

On the surface, the Supreme Court ruling looks like an independent event, until we dig beneath the surface and find big question-marks over the independence of CAR’s judiciary, a country that itself ranks 149/180 on its Corruption Perception Index (extremely low).

As mentioned, one week after CAR announced its Bitcoin strategy, the IMF reported “concerns”, including risks to financial stability, transparency, anti-money laundering efforts, and challenges in managing macroeconomic policies due to the volatility. (Bloomberg, 4 May, 2022)

On 29 Aug 2022, 117 days later, the Supreme Court of CAR ruled that the Sango project was illegal. For context, the Supreme Court which forms part of CAR’s judiciary is described by international transparency bodies such as Gan Integrity as one of the most corrupt institutions in the country, with evidence pointing to inefficiency, political interference, and likely influence from bribes or political pressure.

The Sango project’s collapse became the IMF’s Exhibit A: “Proof Bitcoin can’t work in fragile economies.” But the reality was, the IMF’s consistent expression of “concerns” created the environment where the project was structurally undermined in advance, so that this conclusion became possible.

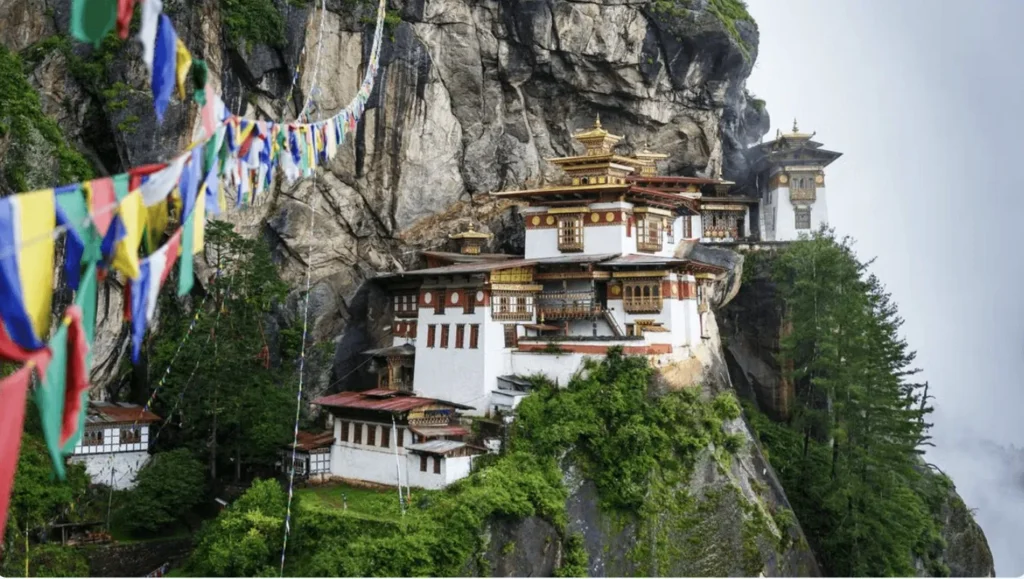

5,200 miles away, in the small nation of Bhutan we see the stark contrast of the successful Bitcoin rollout that was possible without IMF’s “involvement”.

The Unspoken Conclusion: Bitcoin’s Resilience Beyond Borders

CAR’s reversal wasn’t about Bitcoin’s viability. It was about raw power. The IMF weaponized regional banking unions (CEMAC), starved CAR of capital, and leveraged a $191M loan to extinguish the threat of financial sovereignty. When the Sango Project struggled—the trap snapped shut.

Yet this defeat reveals Bitcoin’s enduring power. Notice what the IMF didn’t destroy:

- Nigeria’s Bitcoin remittances still bypass dollar corridors, saving millions in fees.

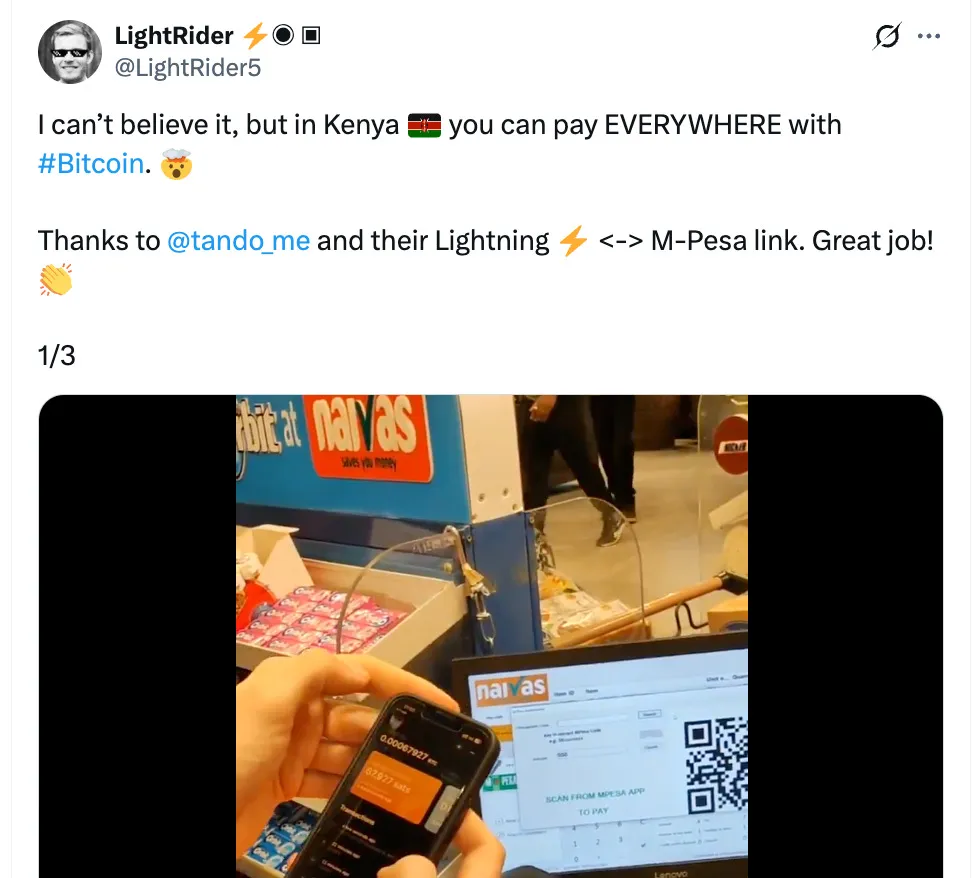

- Kenya’s BTC-powered trade flourishes without IMF approval.

- El Salvador keeps stacking BTC despite 221 mentions of Bitcoin in loan conditions

The pattern is clear: Where grassroots adoption takes root—Bitcoin survives. But for countries announcing top-down Bitcoin manifestos who have large IMF loans, all 4 have met with crushing levels of resistance: El Salvador, CAR, Argentina and now Pakistan.

CAR’s outstanding $115.1 million IMF loan balance made it vulnerable to heavy IMF pressure. In nations without IMF loans such as Bhutan, Bitcoin slips through the IMF’s grip. Every peer-to-peer payment, every Lightning transaction, erodes the old system’s foundations.

The IMF won the CAR round. But the global fight for financial sovereignty is just beginning.

2. Argentina’s $45 Billion Bitcoin Adoption Roadblock

If CAR was thwarted in its Bitcoin plans, Argentina never made it to the start line. Precampaign rhetoric from President Milei suggested big things were in store for Bitcoin. Yet nothing materialized. Was this just a politician’s rhetoric fizzling out post-election, or was something else at play? This section pulls back the lid on what really happened to Argentina’s aborted Bitcoin aspirations.

Understanding how Bitcoin adoption is going, is like assessing whether a rocket is going to reach escape velocity: we must look at both the thrust and drag factors.

My intention is that this newsletter is the place where we can objectively assess not only the positive top-down and grass-roots adoption stories (thrust), but also the strong oppositional forces to adoption (drag) that seldom get discussed, let alone analyzed either on Bitcoin Twitter, or at Bitcoin conferences. One major drag has been environmental FUD, but there is an arguably even bigger one: major institutions that can use their existing debt-entrapment of nations as leverage to prevent Bitcoin adoption.

I’m an optimist: I believe Bitcoin will win: it is so clearly a better solution to the broken money legacy system we currently have. But I’m also a realist: I think most people underestimate the strength of entrenched forces which oppose Bitcoin.

When I was running my tech company, we encountered the same thing. Our technology was 10x better, faster and more cost effective than the legacy system we eventually replaced. But they didn’t relinquish their incumbent monopoly easily!

What happened in Argentina?

When libertarian Javier Milei was elected Argentina’s president in November 2023, many Bitcoin advocates cheered. Here was a leader who called central bankers “scammers,” vowed to abolish Argentina’s central bank (BCRA), and praised Bitcoin as “the natural reaction against Central Bank scammers.” The case became a litmus test for whether Bitcoin could gain mainstream acceptance through government adoption rather than grassroots growth.

Source: Coinsprout. 14 Aug 2023

Yet eighteen months into his presidency, Milei’s Bitcoin vision remains unfulfilled. The reason? A $45 billion leash held by the International Monetary Fund.

The IMF’s Bitcoin Veto in Argentina

The constraints had already been put in place by the time of Milei’s election. On 3 March, 2022, Argentina’s previous government signed a $45 billion IMF bailout agreement. In the weeks following, details emerged that the agreement had contained an unusual clause: a requirement to “discourage cryptocurrency use.” This wasn’t a suggestion—it was a loan condition documented in the IMF’s Letter of Intent, citing concerns about “financial disintermediation.”

The immediate effect:

- Argentina’s central bank banned financial institutions from crypto transactions (BCRA Communication A 7506, May 2022)

- The policy remains enforced under Milei, despite his pro-Bitcoin rhetoric

Milei’s Pivot

After taking office, Milei:

Slashed inflation from 25% monthly to under 5% (May 2024)

Slashed inflation from 25% monthly to under 5% (May 2024)

Lifted currency controls (April 2025)

Lifted currency controls (April 2025)

Secured a new $20 billion IMF deal (April 2025)

Secured a new $20 billion IMF deal (April 2025)

But his manifesto’s flagship proposals—Bitcoin adoption and abolition of BCRA (Argentina’s Central Bank) — are conspicuously absent. The math explains why: Argentina owes the IMF more than any other nation, giving the Fund unparalleled leverage.

Yet there’s irony in Argentina’s case: while the IMF blocks official Bitcoin adoption, Argentinians are embracing Bitcoin anyway. Cryptocurrency ownership grew by 116.5% between 2023-2024 in South America.

Across the region, Argentina has the highest ownership rates, at 18.9%, a figure almost 3 times the global average, and which has surged as citizens hedge against high annual inflation of 47.3% (April 2025) — a quiet rebellion the IMF can’t control.

.

What Comes Next?

All eyes are on the October 2025 mid-term elections. If Milei gains legislative support, he may test the IMF’s red lines. But for now, the lesson is clear: when nations borrow from the IMF, their monetary sovereignty comes with strings attached.

Key Takeaways

- The IMF’s 2022 loan explicitly tied Argentina’s bailout to anti-crypto policies

- Milei has prioritized economic stabilization over Bitcoin advocacy, to maintain IMF support

- Parallels exist in El Salvador, CAR and now Pakistan revealing a consistent IMF playbook

- Argentinians are circumventing restrictions through grassroots Bitcoin adoption

3. El Salvador: A partial IMF-victory

When El Salvador made Bitcoin legal tender in 2021, it wasn’t just adopting a cryptocurrency—it was declaring financial independence. President Nayib Bukele framed it as a rebellion against dollar dominance and a lifeline for the unbanked. Three years later, that rebellion hit a $1.4 billion roadblock: the IMF.

The Price of the Bailout

To secure its 2024 loan, El Salvador agreed to dismantle key pillars of its Bitcoin policy. The conditions reveal a systematic unwinding:

- Voluntary Acceptance Only

Businesses are no longer required to accept Bitcoin (2021 mandate repealed). source - Public Sector Ban

Government entities prohibited from Bitcoin transactions or debt issuance. This includes bans on tokenized instruments tied to Bitcoin. source - Bitcoin Accumulation Freeze

All government purchases halted (6,000+ BTC reserve now frozen)

Full audit of holdings (Chivo wallet, Bitcoin Office) by March 2025. source - Trust Fund Liquidation

Fidebitcoin (conversion fund) to be dissolved with audited transparency. source - Chivo Wallet Phaseout

The $30 incentive program winds down after surveys showed most users traded BTC for USD. source - Tax Payment Rollback

USD becomes the sole option for taxes, eliminating Bitcoin’s utility as sovereign payment. source

Bukele’s Calculated Retreat

El Salvador’s compliance makes fiscal sense:

- The loan stabilizes debt (84% of GDP) as bond payments loom

- Dollarization remains intact (USD still primary currency)

Yet the backtrack is striking given Bukele’s 2021 rhetoric. The Chivo wallet’s low uptake likely made concessions easier.

What’s Left of the Experiment?

The IMF hasn’t killed Bitcoin in El Salvador—just official adoption. Grassroots use persists:

- Bitcoin Beach (local circular economy) still operates, in fact thrives

- Tourism draws increasing numbers of Bitcoin enthusiasts

But without state support, Bitcoin’s role potentially shrinks to a niche tool rather than a monetary revolution, at least in the short term.

The Road Ahead

Two scenarios emerge:

- Slow Fade: Bitcoin becomes a tourist curiosity as IMF conditions take full effect

- Shadow Revival: Private sector keeps it alive despite government retreat

One thing’s clear: when the IMF writes the checks, it also writes the rules.

Key Takeaways

- IMF loan forced El Salvador to reverse 6 key Bitcoin policies

- Precedent set for other nations seeking IMF support

- Grassroots Bitcoin use may outlast government involvement

El Salvador made a lot of Bitcoin concessions. While arguably this doesn’t hurt El Salvador much, it sends a strong message to other LATAM nations such as Ecuador and Guatemala who were watching El Salvador and thinking of copying their playbook (until they checked the size of the IMF loan they had). So on net balance it was a partial IMF win, a partial El Salvador win.

4. Bhutan: the IMF-free success story

We are now 2 years into Bhutan’s Bitcoin experiment.

That means we now have some good data on how it has affected the economy.

The IMF warned that nations embracing Bitcoin would destabilize their economy, be less effective at attracting foreign direct investment, and endanger their decarbonizing and environmental initiatives. It specifically voiced concerns over Bhutan’s “lack of transparency” with crypto-adoption.

What does the data say?

1. The bitcoin reserves have directly addressed pressing fiscal needs. “In June 2023, Bhutan allocated $72 million from its holdings to finance a 50% salary increase for civil servants”

2. Bhutan was able to “use Bitcoin reserves to avert a crisis as foreign currency reserves dwindled to $689 million”

3. Prime Minister Tshering Tobgay in an interview said that bitcoin also “supports free healthcare and environmental projects”

4. Tobgay also said their Bitcoin reserves helped in “stabilizing [the nation’s] $3.5 billion economy”

5. Independent analysts have now said that “this model could attract foreign investment, particularly for nations with untapped renewable resources”

Considering how the IMF analysis was not just wrong, but roughly 180° off target, it begs the question, were the IMF’s predictions ever based on data?

5. Five reasons the IMF may fear Bitcoin

“Get all your friends, libertarians, democrats, republicans, get everyone to buy Bitcoin – and then it becomes democratized.” encouraged John Perkins ~ Bitcoin 2025

What if the IMF’s greatest fear isn’t inflation… but Bitcoin, and can Bitcoin Break the IMF/World Bank Debt Grip?

During my recent conversation with John Perkins (Confessions of an Economic Hit Man), something clicked. Alex Gladstein previously and brutally exposed how IMF “structural adjustments” did not eliminate poverty, but in fact enriched creditor nations. Perkins layered this with his own first-hand accounts.

Perkins laid bare to me how the Global South is trapped in a cycle of debt—one designed to keep wealth flowing West. But here’s the twist: Bitcoin is already dismantling the playbook in five key ways.

1. Reducing Remittance Costs to Loosen the Debt Noose

Chris Collins’ Sculpture symbolically captures the debt noose

Remittances—money sent home by migrant workers—often make up a significant part of developing nations’ GDP. Traditional intermediaries such as Western Union charge fees as high as 5–10%. This acts as a hidden tax that drains foreign reserves. For countries like El Salvador or Nigeria, every remittance dollar that doesn’t flow into the country is a dollar their central bank must store to stabilize their currencies. Often this store of US dollars is provided by the IMF.

1. Bitcoin Changes the Game

With Lightning, fees drop to almost zero, and transactions settle in seconds. In 2021, El Salvador’s president Bukele optimistically predicted that bitcoin could save $400 Million in remittance payments. The reality has been there’s little evidence remittance payments using bitcoin have reached anywhere near that threshold. However the potential is clear: more remittances in bitcoin leads to higher dollar reserves, which leads to less need for IMF loans.

Little wonder the IMF mentioned Bitcoin 221 times in their 2025 loan conditions for El Salvador. They’d like to remain a relevant lender.

Bitcoin isn’t just cheaper for remittances—it bypasses the dollar system entirely. In Nigeria, where the naira struggles, families now hold BTC as a harder asset than local currency. No need for central banks to burn through dollar reserves. No desperate IMF bailouts.

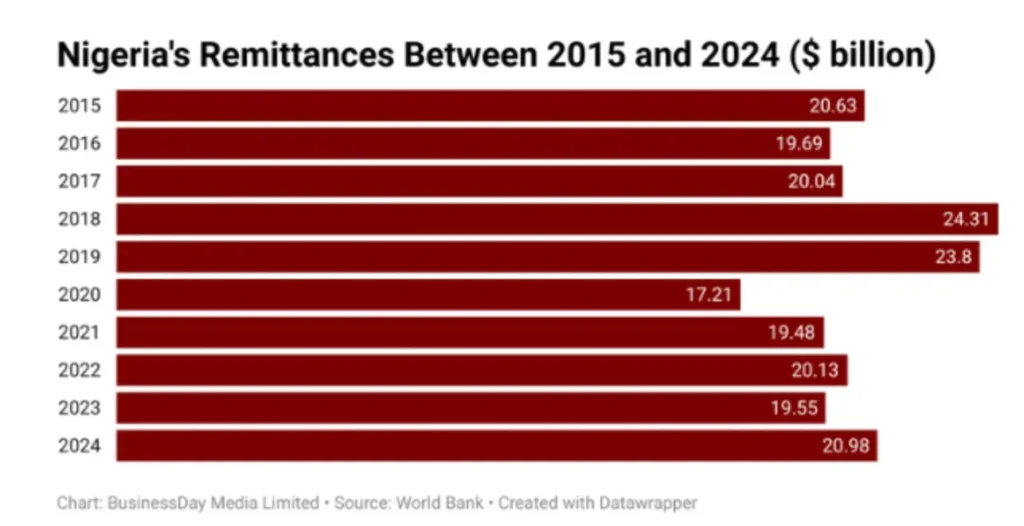

The numbers speak for themselves:

• Pakistan loses $1.8 billion yearly on remittance fees—Bitcoin could save most of that

• El Salvador already saves $4M+ annually with just 1.1% Bitcoin remittance adoption

Adoption isn’t universal yet—only 12% of Salvadorans use Bitcoin regularly, while over 5% of Nigeria’s remittances flow through crypto. But the trend is clear: every Bitcoin transfer weakens the debt dependency cycle.

The IMF sees the threat. The question is: how fast will this silent revolution spread?”

Remittances totaled almost $21 billion in 2024, representing over 4% of Nigeria’s GDP

2. Evading Sanctions and Trade Barriers

Oil-rich Iran, Venezuela and Russia have had restricted USD access due to US sanctions in 1979, 2017 and 2022 respectively, resulting in the export of vastly fewer barrels per day of oil in each case.

Whether we agree with the ideologies of these nations or not, Bitcoin breaks this cycle. Iran already evades sanctions by using Bitcoin as a way to effectively “export oil”, whereas Venezuela has used Bitcoin to pay for imports, evading sanctions.

Iran is also able to bypass sanctions by monetizing its energy exports through mining. This avoids the IMF’s “reform-for-cash” ultimatums while keeping economies running.

The petrodollar’s grip weakens as Russia and Iran pioneer Bitcoin oil deals.

Another nation that has used Bitcoin to avoid the economic hardship caused by sanctions is Afghanistan, where humanitarian aid flows through using Bitcoin. NGOs like Code to Inspire bypassed Taliban banking freezes, and Digital Citizen Fund have used Bitcoin to deliver aid post-Taliban takeover, preventing families from starving.

Afghanistan’s “Code to Inspire” NGO uses Bitcoin donations, which cannot be intercepted by the Taliban, to train women to write software.

Though Bitcoin’s share of sanctioned trade is small—under 2% for Iran and Venezuela’s oil exports—the trend is growing.

Sanctions are a critical tool for geopolitical leverage, often supported by the IMF and World Bank through their alignment with major economies like the U.S. Sanctioned nations using Bitcoin reduces IMF control over financial flows while simultaneously threatening U.S. dollar dominance.

3. Using Bitcoin as a Nation State Inflation Shield

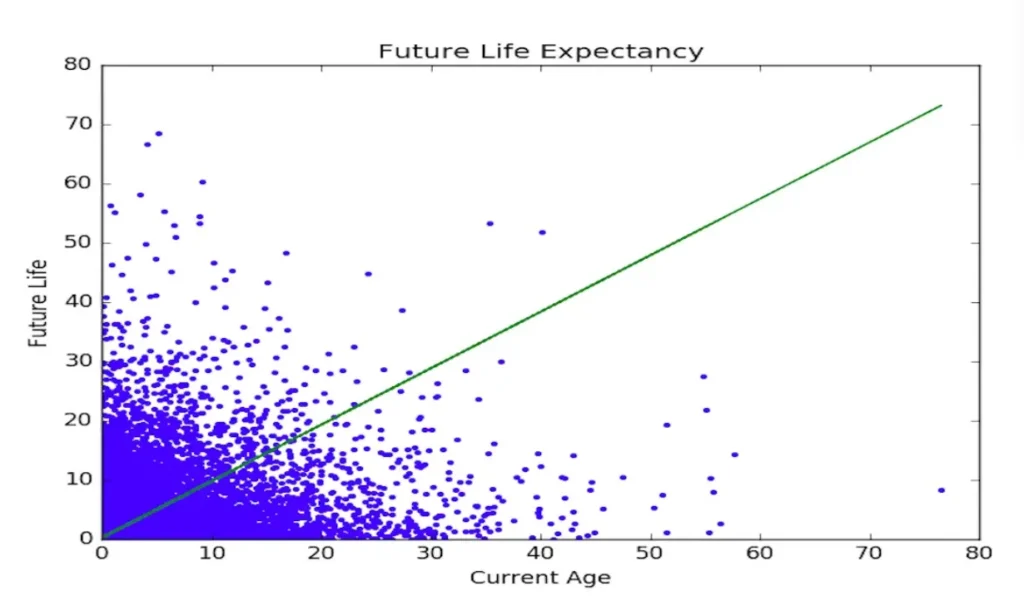

When nations like Argentina face hyperinflation, they borrow USD from the IMF to bolster currency reserves and stabilize their currency, only to face austerity or the enforced sale of strategic assets at a low price when repayments falter. Bitcoin offers a way out by acting as a global, non-inflatable currency that operates independently of government oversight, and which appreciates in value.

El Salvador’s experiment shows how Bitcoin can reduce dollar dependency. By holding BTC, nations can hedge against currency collapse without IMF loans. If Argentina had allocated just 1% of its reserves to Bitcoin in 2018, it could’ve offset the peso’s 90%+ devaluation that year, sidestepping an IMF bailout. Bitcoin’s neutrality also means no single entity can impose conditions, unlike IMF loans that demand privatization or unpopular reforms.

Bitcoin doesn’t have debt-leverage or a long history of the IMF to draw on when encouraging adoption. However, due to the Lindy Effect (see chart below), each passing year Bitcoin becomes a more viable alternative.

Lindy Effect: The longer something has been successful, the more likely it is to continue being successful. Bitcoin’s longevity strengthens its potential to disrupt

4. Bitcoin Mining: Turning Energy into Debt-Free Wealth

Many developing nations are energy-rich but debt-poor, trapped by IMF loans for infrastructure like dams or power plants. These loans demand cheap energy exports or resource concessions when defaults hit. Bitcoin mining flips this script by turning stranded energy—like flared gas or overflow hydro—into liquid wealth without middlemen or transport costs.

Paraguay’s earning $50 million yearly from hydro-powered mining, covering 5% of its trade deficit. Ethiopia made $55 million in 10 months. Bhutan’s the standout: with 1.1 billion in Bitcoin (36% of its $3.02 billion GDP), its hydro-powered mining could produce $1.25 billion annually by mid-2025, servicing its $403 million World Bank and $527 million ADB debts without austerity or privatization. Unlike IMF loans, mined Bitcoin appreciates in value and can be used as collateral for non-IMF borrowing. This model—monetizing energy without surrendering assets—scares the IMF, as it cuts their leverage over the energy sector.

Bhutan’s Prime Minister, Tshering Tobgay, calls Bitcoin a “strategic choice to prevent brain drain”

5. Grassroots Bitcoin Economies: Power from the Ground Up

Bitcoin is not just for nations—it’s for communities. In places like El Salvador’s Bitcoin Beach or South Africa’s Bitcoin Ekasi, locals already use BTC for daily transactions, savings, and community projects like schools or clinics. These circular economies, often sparked by philanthropy, aim for self-sufficiency. In Argentina, where inflation often tops 100%, 21% of people used crypto by 2021 to protect wealth. If scaled up, these models could reduce reliance on national debt-funded programs, which is of course the last thing the IMF want.

Hermann Vivier, founder of Bitcoin Ekasi, says his community was inspired by El Salvador’s Bitcoin Beach to replicate their Bitcoin circular economy in S.Africa

Conclusion

By fostering local resilience, Bitcoin undermines the IMF’s “crisis leverage”. Thriving communities don’t need bailouts, so the IMF can’t demand privatization in exchange for loans. In Africa, projects like Gridless Energy’s – which has already brought 28,000 rural Africans out of energy poverty using renewable microgrids tied to Bitcoin mining – cut the need for IMF-backed mega-projects. If thousands of towns adopt this, dollar shortages would matter less, and trade could bypass USD systems.

While the IMF occasionally engages in spreading misinformation about Bitcoin energy consumption and environmental impact as a way to obstruct adoption, its preferred and much more powerful tool is simply to use the financial leverage it has over IMF-indebted nations to voice “strongly encourage” compliance with its Bitcoinless vision of the future.

The IMF fought Bitcoin adoption in El Salvador, CAR, and Argentina. Now they are fighting Pakistan’s intention to mine Bitcoin as a Nation State. Scaling these grassroots efforts is likely to force the IMF’s hand to crack down more and more transparently.

Above: Children from South Africa’s poorest villages learn to surf via the Bitcoin Ekasi township project

Grassroots Bitcoin economies empower communities to thrive without IMF bailouts. And people-power is needed to find new innovative ways to overcome the IMF’s counterpunch.

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post How The IMF Prevents Global Bitcoin Adoption (And Why They Do It) first appeared on Bitcoin Magazine and is written by Daniel Batten.

from Bitcoin Magazine

Daniel Batten

0 Comments