The subtle shift in social media conversations. The mentions in the mainstream media: “Bitcoin will now be available for Wall Street investors!”. All the text messages arriving with questions about bitcoin from your no-coiner friends. Bitcoiners know that this is the signal. The bull market is officially here before the 2024 halving. This is a letter and a brief guide with nice tools for all those people who have been asking questions about bitcoin in the last couple days.

"Bitcoin... Should I buy it?" “What is the best way to buy some?” “When should I buy it?” “How much do I buy?” “What strategy do I use to accumulate?” “Do I keep it? How long?”

Gradually and then suddenly. That weird magic internet money you spend your free time researching is all anyone wants to talk about now. Your coworker, usually oblivious to anything outside his immediate domain, starts peppering you with questions about exchanges and wallets. Your high school and college friends text you asking for advice.

The no-coiner texts are more than just a social phenomenon. They're a barometer of market sentiment, a bellwether signaling the rise of a new wave of interest. When the questions shift from "What is Bitcoin?" to "How do I buy it?" you know something fundamental has shifted.

This isn't just FOMO (fear of missing out). It's recognition. People are starting to see what we've seen all along: a monetary revolution unfolding before our eyes. The limitations of the old system, the fragility of fiat currencies, are becoming painfully obvious. And Bitcoin, that beacon of sound money and individual sovereignty, shines ever brighter in the growing darkness.

The questions, of course, are varied. "Should I buy now?" asks the cautious one, still scarred by past price swings. "What exchange should I use?" queries the practical one, seeking a secure path to entry. And the adventurous one, eyes gleaming with gold rush fever, wants to know about leverage and trading strategies.

There's no one-size-fits-all answer, of course. Each journey into Bitcoin is unique, shaped by individual circumstances and risk tolerance. But for those drawn to the flight to quality, let's go step by step.

“Should I Buy Bitcoin?”

This is not investment advice. Before investing any money, I would suggest that you invest time doing your own research about how to use the Bitcoin network appropriately. That said, the world's largest asset manager is very bullish on Bitcoin. According to a BlackRock paper from 2022, they believe that an 84.9% bitcoin allocation is the optimal strategy.

Additionally, Fidelity published a paper titled Introduction to Digital Assets For Institutional Investors and they mention Bitcoin 73 times. After that, they published a paper titled Bitcoin First: Why investors need to consider Bitcoin separately from other digital assets.

Again, that doesn’t mean you should trust them with your eyes closed. I encourage everyone to do their own research. This is simply a little bit of context about what giants in the asset management industry are saying lately. There are open source tools that can help you make your own conclusions. Any person can access and understand how to use these tools for their personal wealth management. In fact, you can play with the models and adjust anything if you know some programming in Python. Finally, the Bitcoin network has so many unique characteristics that make it like no other asset we've seen before. Bitcoin rocks!

“What Is The Best Way To Buy Some?”

It depends on individual needs, priorities and trade offs. On one side, you need to choose the level of responsibility that you're comfortable with. On another side, you need to decide on the level of ownership that you want to have over your wealth.

For example, there will be individuals that prefer to give up absolute ownership because they'd rather have a third-party as the custodian of the bitcoin. Long time bitcoiners value absolute ownership and therefore they prefer to be the custodians of their own bitcoins even if that implies more responsibility for them. Holding your own keys is the only way to really own any bitcoin. That's why they say: “Not your keys, not your bitcoin”. If you really want to be your own bank, you can’t delegate the responsibility of holding your keys to anyone else.

There is no doubt that not everyone prefers the big responsibility of holding their bitcoin. The same thing happened with other assets like gold. Not everyone feels comfortable storing gold in their homes and they send their gold to third-party custodians that have big gold vaults. In cyberspace there are also technicalities that will make some individuals feel unable to keep up with the big responsibility of holding value without the help of a third-party.

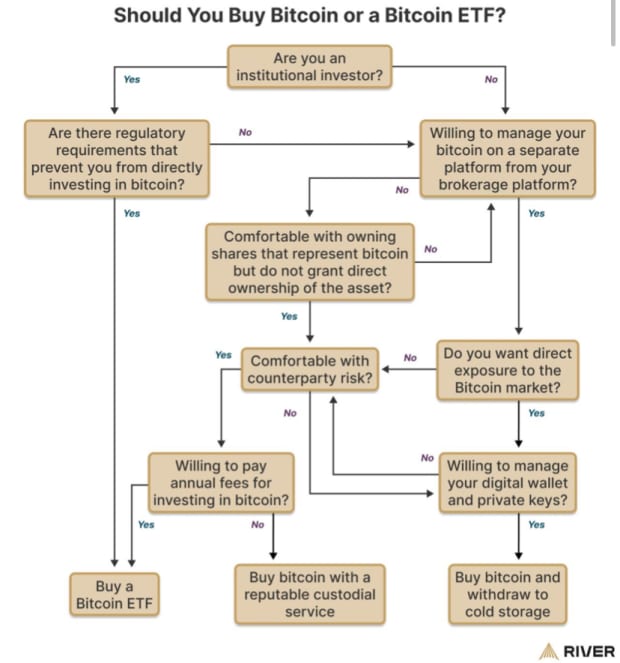

Ask yourself the following questions: Do you value absolute ownerships? Do you value privacy? Are you comfortable with the responsibility of holding your keys safely? How much trust do you have in a third-party to custody your wealth? Are you an individual or institutional investor? If you are an institutional investor, are there regulations preventing you from owning real bitcoin? The following diagram from River can help you decide which is the best way for you to buy and hold bitcoin.

In conclusion, there are three different alternatives depending on individual needs. First, owning real bitcoin with a hardware wallet that you own the keys to. Second, buying paper bitcoin and having a third-party do the custody for you. Third, buying a Bitcoin ETF and having your broker keep it for you. After all, you can use a mix of different strategies either to diversify your exposure or invest from different platforms.

“When Should I Buy It?”

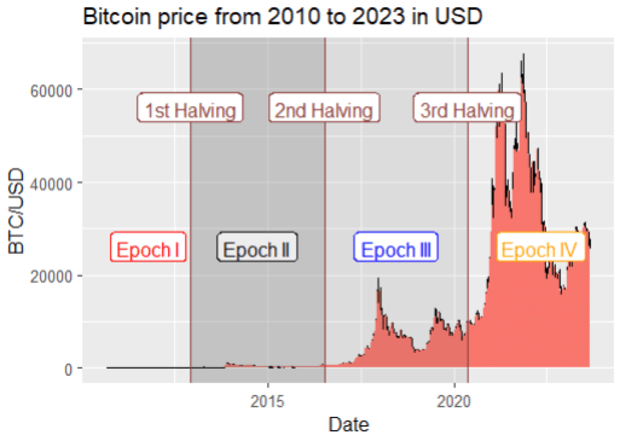

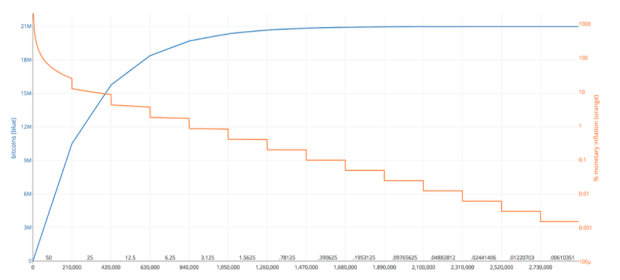

Approximately every four years there is an event called the Halving. A halving implies that the amount of bitcoins put into circulation is cut into half. This is known as the Block Reward or Block Subsidy. In 2023, the Block Reward was equivalent to 6.25 Bitcoin coins. The Block Reward refers to the number of coins issued every 10 minutes. This means that 900 bitcoins were created each day.

In 2010, the Block Reward was 50 coins. During a Halving, the Block Reward is halved, marking significant epochs in the life of the Bitcoin network. We are currently in the 4th epoch (Epoch IV), which began in 2020 and will end in 2024.

Therefore, with the Halving in 2024, the monetary issuance will decrease to 3.125 coins every 10 minutes. This halving is expected to occur around April and in other words, a halving causes an anticipated decrease in the growth rate of the monetary base. The halving and the Epoch are crucial considerations for those interested in investing in Bitcoin. In the following graph you can visualize this:

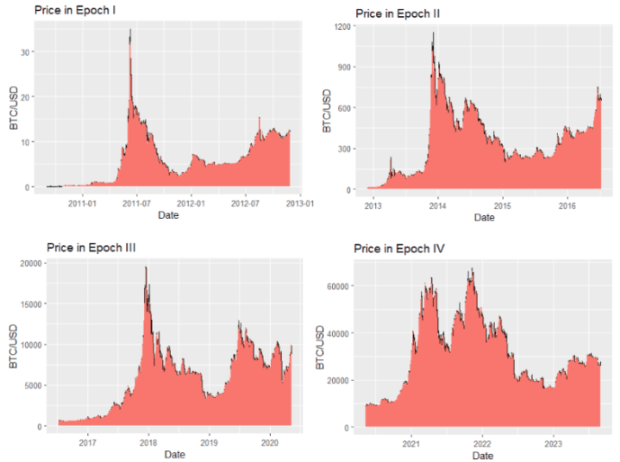

The following charts contain Bitcoin price data for each epoch separately (from Epoch I to Epoch IV, respectively). What's intriguing about these four charts is that they help us visualize a clear pattern that repeats in each epoch. These charts can be valuable to anyone interested in investing in Bitcoin, as they assist us in visualizing a very distinct cycle that repeats every four years.

It is important to mention that we do not know if the four year cycle will continue forever. In the last few years there have been new conversations that suggest that the four year cycle will not always be like that. A popular argument is that the halving will be priced in with anticipation for future epochs when people become more aware of this phenomenon.

There are currently 19.7 billion bitcoins in circulation out of the 21 million that there will ever exist. This means that 93% of the total bitcoins already exist and there is less than 7% of them to be mined. However, the last bitcoins will be mined around the year 2140 and miners will live off of transaction fees after that.

*Source: https://medium.com/swlh/the-mathematics-of-bitcoin-89e7ab59edc

“How Much Do I Buy?”

Once you have decided to buy bitcoin, the next step is to ask yourself how much you want to invest. Remember the advice from that Blackrock publication? You don't have to be that aggressive and invest 84% of your portfolio in bitcoins. You can begin little by little. In this section, I will use a wonderful open-source tool created by Raphael Zagury (Chief Investment Officer of Swan Bitcoin) and I would suggest everyone to play with the models in the platform by yourself. You can find this dashboard at https://nakamotoportfolio.com/.

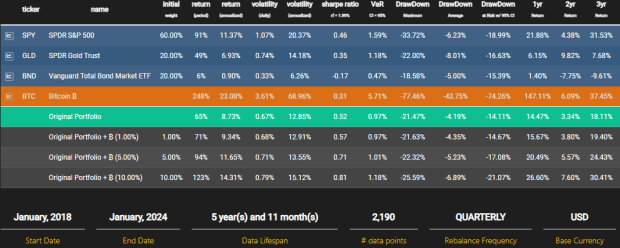

In the Nakamoto Portfolio website, you can personalize a portfolio to meet your needs or you can check out default portfolios templates that are already there for you to analyze. Let's check out a very simple and traditional portfolio:

This portfolio has 60% of its wealth invested in the S&P 500 Index (SPY), 20% in a regular gold trust (GLD), and the other 20% in a Vanguard Bond Market ETF (BND). The time frame used to analyze this portfolio is between January 2018 and January 2024. The green line shows us the actual results that this portfolio would`ve had during that time span. The results tell us that this portfolio would have had an annual return of 8.73%. The total return for the six year period is 65%. The daily volatility of this portfolio is 0.67% and the annualized volatility is 12.85%.

Now let's focus on the three lines below the green line that represents the original portfolio. These lines give us the results of the original portfolio if they would have had 1%, 5% and 10% of the portfolio in Bitcoin for those six years. Just by having 1% in Bitcoin, the total returns of the portfolio would go from 65% to 71%. The annualized volatility would only increase to 12.91%. A position of 5% in Bitcoin would increase the returns all the way to 94% with the volatility at 13.55%. Finally, a position of 10% in Bitcoin would take the returns all the way to 123% and the volatility would only increase to 15.12%. This exercise illustrates perfectly why exposure to Bitcoin (even minimum exposure) is ideal for any portfolio.

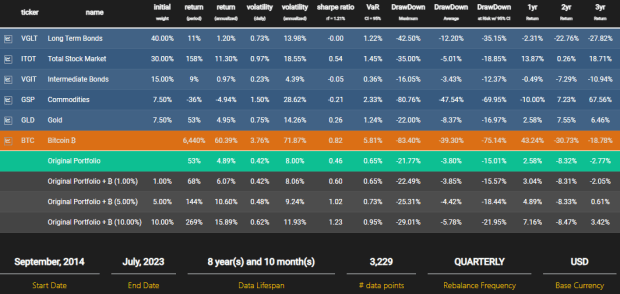

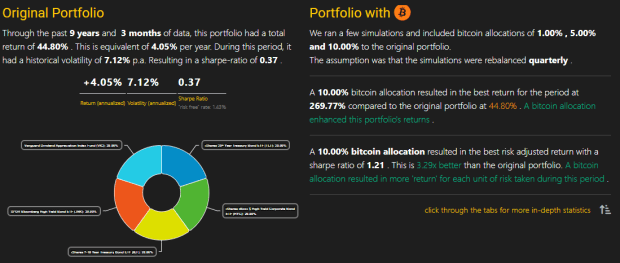

Ray Dalio, the famous investor from Bridgewater Associates, created a portfolio designed to perform well across different economic conditions. This investment strategy is known as the All Weather Portfolio. This portfolio template is available on the Nakamoto Portfolio website to analyze the results of Bitcoin exposure. The following image demonstrates the benefits of adding Bitcoin to a portfolio like this one.

Another interesting portfolio to check out is the Diversified Bond Portfolio. This is a conservative investment strategy for risk-averse individuals. This portfolio includes a mix of Treasury with High Yield ETFs. According to Mr. Zagury, “a Bitcoin allocation is the perfect implementation of a bond portfolio. Even at small amounts, it has the potential to increase risk-adjusted returns.” The following image contains a brief summary of the impact that Bitcoin exposure can have on the Diversified Bond Portfolio. I suggest for everyone to try out the Nakamoto Portfolio by themselves to play with different numbers, portfolios, strategies, etc. There are YouTube tutorials and Twitter Threads to help anyone that is interested in using this wonderful tool.

“What Strategy Do I Use To Accumulate?”

Once you have decided that you want to buy some bitcoin and you have decided on the amount of exposure that you want, the next step is to decide how you want to approach this accumulation phase. What strategy do you want to buy bitcoin? On one hand, you can buy it all at once. On the other hand, you can buy little by little.

There are two main strategies for bitcoin accumulation: Lump-sum Investing and Dollar Cost Averaging (DCA). A lump-sum strategy implies investing all available funds at once. The DCA strategy allocates funds over regular intervals. For example, someone that decides to buy $100 worth of bitcoin each week (no matter the price) is following a DCA strategy. This is a popular strategy among bitcoiners that want to stack sats consistently. Each strategy has its own pros and cons. However, the best strategy depends on the particular needs and preferences of each individual.

The Nakamoto Portfolio website also has a tool where anyone can run the numbers and compare which strategy works better for their particular situation. Check out the BTC Cost Averaging Simulator. According to Swan´s Nakamoto Portfolio, “lump-sum investing has historically outperformed DCA strategies. This is primarily due to Bitcoin's explosive upward price movements. But DCA can lead to significant outperformance during bear markets. For instance, investors who bought at all-time highs but employed DCA afterward were able to break even significantly quicker. While DCA has potential drawbacks, such as reduced returns in consistently rising markets, it remains a popular method for managing risk and promoting disciplined investing.” After all, most people use a mix of both of these strategies and that might be the best way to go.

“Do I Keep Tt? For How Long?”

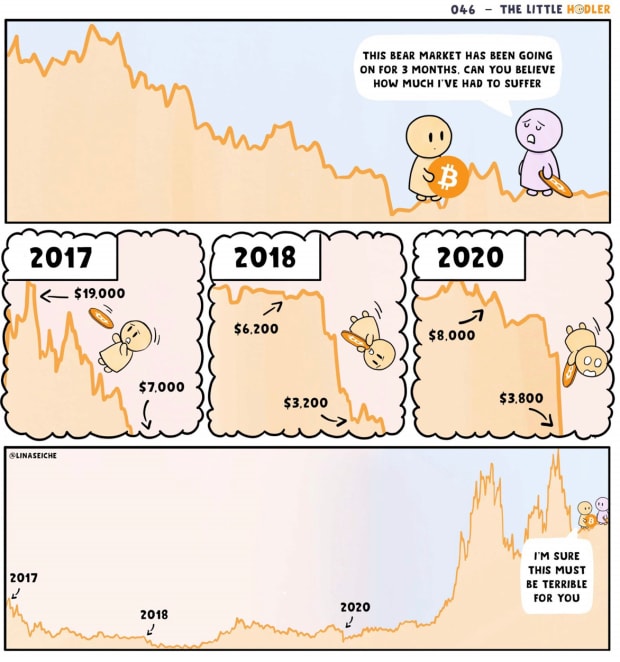

Again, that comes down to individual needs, priorities, information, etc. However, this asset should be considered a long-term investment strategy. That means holding your bitcoin for a very long time, regardless of price fluctuations. Many Bitcoin enthusiasts believe that bitcoin will eventually become a global reserve currency, and therefore, they are willing to hold it through the ups and downs of the market. There is a popular saying amongst bitcoiners that changes “hold” into “HODL” (Hold On For Dear Life!). Take a look at awesome bitcoin comics that might also give you some advice…

Other investors prefer trading their bitcoin on a frequent basis. This strategy involves buying bitcoin during the dips and selling during the highs. It sounds too cool but in reality this decentralized market is very difficult to predict. Very rarely do traders get to outsmart the market. Time in the market is more important than timing the market.

I encourage readers to take the next step, whether it's researching Bitcoin on their own, starting a Bitcoin investment plan, or joining the Bitcoin community. Start your Bitcoin journey today! Dive into the resources, explore the Nakamoto Portfolio, and don't hesitate to ask questions. Bitcoin awaits those who dare to step into the future. As Bitcoin continues its ascent, how will the world adapt to this new paradigm of sound money and individual sovereignty? Only time will tell, but one thing is certain: the future is orange.

This is a guest post by Santiago Varela. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

from Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Santiago Varela

0 Comments