Since the early days of Bitcoin, the price has typically followed the patterns of the stock market and the price of gold. Are we beginning to see a decoupling?

This is an opinion editorial by Mike Ermolaev, head of public relations and content at Kikimora Labs.

Setting The Context: Global Economy Fundamentals

The economy is still recovering from the COVID-19 outbreak as new problems arise. We are now in a time of rampant inflation with central banks trying to remedy that by raising interest rates.

The U.S. CPI data (consumer price index), released on October 13, came in higher than expected (8.2% year-over-year), negatively impacting the bitcoin price. But inflation is not the only issue, the global economy is also struggling with the energy crisis, affecting Europe more than the U.S., due to its strong dependency on Russian natural gas and raw material.

On the eastern side, the war in Ukraine with ensuing sanctions on Russia, add further geopolitical instability and economic uncertainty. Also, China’s zero-COVID policy is disrupting the supply chain worldwide, and the Evergrande default undermines one of the world’s biggest economies.

If we look at the main currencies, the dollar index looks strong, compared to others. The Federal Reserve raised interest rates by 75 basis points in November, and the Bank of England raised interest rates by the same amount. This policy of quantitative tightening aims to reduce the money supply and mitigate price pressure. It is likely to continue into next year and beyond. However, a global recession and risk of stagflation is still very strong, so no country may feel safe from central bank monetary policy.

Bitcoin Correlation With The Economy

Bitcoin has shown not to be immune from this global turmoil. Although the price in its early stage was independent of traditional finance, correlation began to show in 2016.

The idea of bitcoin as a “digital gold” became popular because both shared the scarcity and difficulty of extraction (mining), as well as fulfilled the role of being a store of value. Since many view bitcoin as a risk asset, its correlation with the S&P 500 and Nasdaq-100 became visible — no different than traditional stocks.

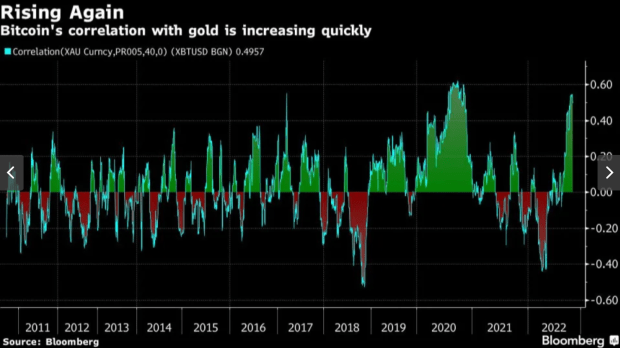

At the time of writing, bitcoin’s 40-day price correlation with gold reached 0.50 (after being around zero in August). According to Alkesh Shah and Andrew Moss, strategists from Bank of America:

“A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen.”

Negative Events

There are some macroeconomic factors in the larger cryptocurrency ecosystem that contributed to a bearish market: the Terra/LUNA collapse, forced liquidation of Three Arrows Capital and the bankruptcy of Celsius being the main ones.

The incoming bitcoin mining regulations by the EU and the current profitability crisis of bitcoin mining must be also taken into consideration.

Bitcoin: Present And Future

Despite all the above adverse events, bitcoin was able to somehow keep its price in the $19,000-$20,000 range, with record-low volatility. Currently, we are observing unusual stability in the bitcoin price, recently even matching volatility of the British pound.

On the contrary, stocks have experienced high volatility and whipsaw price action, also following speculations about the Fed’s future decisions. According to Bloomberg’s Chief Commodity Strategist Mike McGlone, that’s why bitcoin may rise after a steep discount and eventually beat the S&P 500. He believes that bitcoin’s finite supply and deflationary approach may help it recover its previous price levels.

Since the last flash crash in mid-June, the price has been quite steady, but we know it rarely sits still for too long. This means that the probability of a sudden (bullish or bearish) breakout increases over time. The longer the price remains idle, the stronger the breakout is going to be.

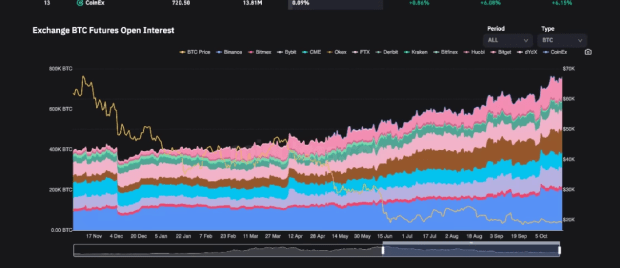

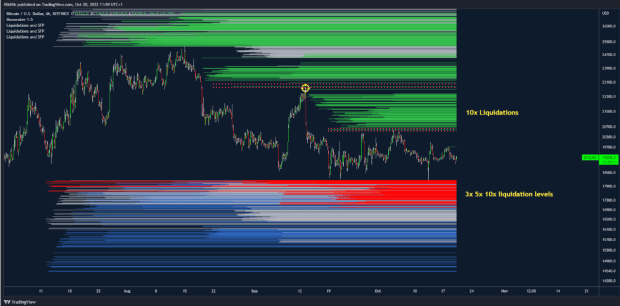

Additionally, the BTC futures open interest is higher than ever, with liquidations reaching all-time low. A lot of liquidity is accumulating here, meaning that there will be an even stronger impulse when the price starts to move again.

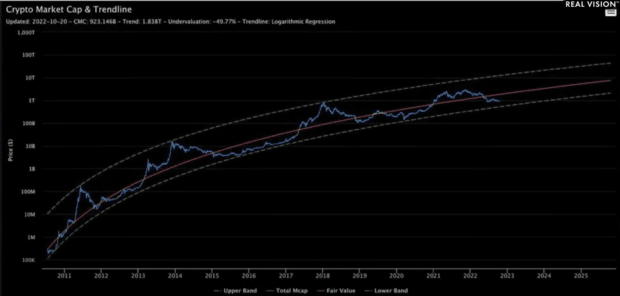

According to the strategist Benjamin Cowen, bitcoin is expected to rise to “fair value,” after falling an additional 15%. “Right now, the data would suggest that we’re about 50% undervalued compared to where the fair value is.” Cowen thinks we may need to wait until early 2024 to see this rise happen.

Goldman Sachs strategist Kamakshya Trivedi has a different view, claiming that the U.S. dollar index, showing record values since 2002, may be bad news for the currently bearish bitcoin.

A Bearish Scenario: Could The 2018 Drop Happen Again?

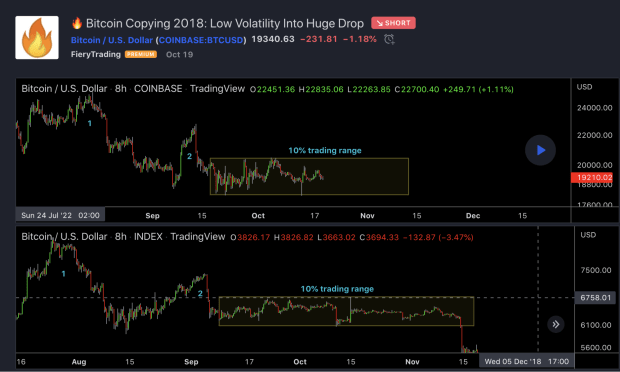

Some analysts have been wondering if the 2018 scenario (low volatility, then big price drop) may happen again today because the market conditions look quite similar. We have the same 10% trading range and we know something is going to happen soon.

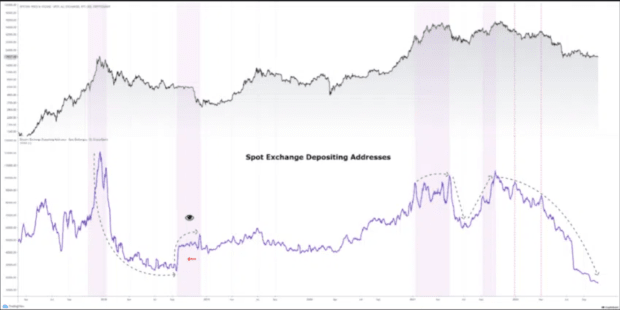

A remarkable difference between the two cycles is that in 2018 there was an increase in addresses sent to spot exchanges, while in our current cycle we are observing liquidity moving away from exchanges and not many new addresses being created. According to a CryptoQuant analyst, this should mean that we won’t witness a similar scenario to 2018.

What About Uptober and Moonvember?

Historically, Q4 is a great time for bitcoin, with bullish trends starting in October and increasing in November. So the months of October and November were colloquially renamed “Uptober” and “Moonvember” — at least, this is what happened back in 2021.

Can we still expect such a bullish Q4 in 2022? It’s hard to say, but the adverse macroeconomic situation and geopolitical issues make it harder to imagine the same rally we saw last year. After all, the bitcoin market has been down for 10 consecutive months and we don’t see any particular sign of recovery at the moment.

We must also keep in mind that, despite the negative global scenario, the “safe haven” role of bitcoin may contribute to giving the price some additional strength, especially in these troubled times.

Exchange Data Analysis

Liquidation data on the Bitfinex exchange was analyzed by filbfilb. He concluded that an upward breakout would have less momentum than a downward one. In fact, liquidity above $20,500 is mostly 10x, while liquidity below $18,000 is predominantly 10x, 5x and 3x, which means that a bullish breakout would be “less brutal” than a bearish one.

Conclusions

We are currently witnessing a period of stasis in the bitcoin market. The bitcoin price needs to start moving again after two months of consolidation. The overall economic scenario doesn’t look bright at all, and bitcoin is correlated to events in the real world, but investors can still recognize the digital gold, safe-haven role of the most popular cryptocurrency. A strong bitcoin price breakout is expected, with new volatility incoming.

The possible scenarios may be: a quick dump and then a bullish recovery (V-shaped bounce) or a longer and deeper price collapse, after the break of the $19,000 resistance level.

Whatever happens, bitcoin will keep being the most innovative technology of the last decade, allowing financial freedom and direct control over one’s own wealth. Bitcoin has historically witnessed numerous strong bearish times and has always recovered from them.

This is a guest post by Mike Ermolaev. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

from Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Mike Ermolaev

0 Comments