The trend of fiat currency inflation in 2021 will worsen in 2022, and those holding bitcoin have planned for it.

Inflation was one of the most widely-debated topics in the mainstream media throughout 2021. We’ve been fed lies throughout the year, with some outlets suggesting that inflation doesn’t exist, inflation is low, inflation is transitory or inflation is good. Anyone paying attention knows none of these things are true. Inflation is absolutely here, it’s not going anywhere anytime soon, and while we could debate whether modest inflation is good or bad for an economy, the levels of inflation we’re currently seeing are very concerning.

As I look ahead to 2022, here are some questions on my mind regarding inflation:

- How high will inflation go in the U.S. and other countries with relatively stable currencies?

- Will we see another currency crisis like that which is currently happening in Lebanon?

- What will be the public sentiment in response to sustained, high inflation?

- Will more people wake up to the reality that the value of their money is eroding by the day?

- Will bitcoin adoption explode over the next year as more people come to this reality?

How Will Inflation Impact Bitcoin In 2022

It seems pretty obvious that high inflation is destined to continue for the foreseeable future. Over the summer, in the U.S., we saw the highest year-over-year rise in inflation since 2008, and that was at a reported 5% increase. People would be right to wonder what the “true rate” of inflation is.

The Consumer Price Index (CPI) is a statistic used by the likes of the Federal Reserve and other government agencies to represent a standard cost of living, but the measuring stick has changed multiple times over the years, consistently resulting in lower reported numbers with each methodological shift. Per Shadow Stats, using an older and more accurate measure of inflation from 1980, inflation sits today closer to 15%. I’m confident that most people would say inflation feels a lot closer to 15% than it does to 5%.

So, what does this mean for bitcoin? Bitcoin is an inflation hedge after all, right?

I’m not so certain that sustained, high inflation will result in a short-term price jump for bitcoin. The reason I say this is because of this feeling that the financial system underpinning the global economy is broken and due for a day of reckoning. The modern-day fiat currency experiment that took shape 50 years ago when President Nixon severed our remaining ties to the gold standard has failed. As opposed to thinking about what bitcoin’s price will be in U.S. dollar terms in six months, one year or even five years from now, I often find myself thinking about the compounding damage being caused by reckless monetary policy all over the world.

I strongly encourage you to watch the below interview with Lawrence Lepard where he discusses this very subject:

Many believe that a collapse of the U.S. dollar would be an extreme scenario, but would a serious financial pullback in the near future be that far fetched? The argument that inflation is good for bitcoin is mostly true. It opens peoples’ eyes to a better system, but a resulting recession or depression would certainly result in a sharp drop in asset prices across the board, bitcoin included.

Bitcoin’s Correlation To Other Markets In 2022

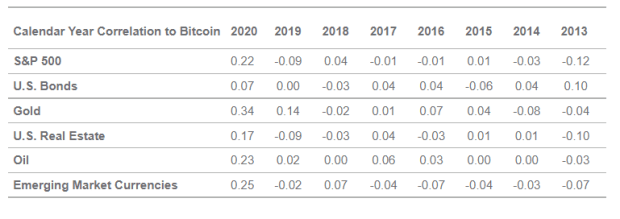

Another idea discussed in the above video is bitcoin’s increasing correlation to the S&P 500. Through 2019, there was virtually no relationship between bitcoin and the S&P 500 (or really any other major asset class for that matter), but a slight correlation was noted in 2020 and it’s strengthened throughout 2021.

Is this a trend that will continue as more institutional investors come on board and we have more publicly-traded bitcoin companies? If more investors who typically haven’t looked at bitcoin start buying it, then bitcoin’s “behavior” will start to more closely mirror that of those investors and asset managers.

While these are a couple of topics that I’ll be keeping a close eye on throughout 2022, the points above don’t impact my personal investment thesis: buy bitcoin. I’d be lying if I said I didn’t track its short-term price movements, but whether we rip past $100,000 or fall back down to $30,000, it won’t change my conviction in the slightest. A rise in the price of bitcoin simply means that I’m able to buy less and dips mean I’m able to stack more.

Are Bitcoiners Rooting For Inflation?

The idea that bitcoiners root for inflation is troubling to me and inconsistent with my interactions with the bitcoin community.

Most of the bitcoiners I’ve met care deeply about the world. They are not degenerate price speculators as the mainstream media has painted them out to be, they are investors, learners, builders, humanitarians and philosophers. Bitcoiners just happen to pursue a path toward the betterment of humanity that most people don’t understand and that many incumbents of the current financial and social system are threatened by.

What I’ve found is that Bitcoiners don’t “root” for inflation, but rather, they recognize it, and they loathe it. Inflation strips hard working men and women of their purchasing power. Inflation hurts the poor at the expense of the rich. It breeds corruption, it encourages greed and it distracts from financial responsibility.

These ideas are antithetical to that of Bitcoin. Hell, they are antithetical to that of a fair and prosperous society. So, no, we’re not rooting for inflation. We simply recognize it. We recognize the lies being fed to us pretending that it doesn’t exist or that it’s transitory or that it isn’t a big deal. Bitcoiners don’t root for inflation, we plan for it.

Planning Ahead For 2022

Are we at the tipping point that Foss references in the quote above? Maybe we’ve already passed it? Is Lepard’s prediction of the fall of the U.S. dollar in as little as a few years alarmist? Or is he on to something?

Last rhetorical question, for now: Have you thought about what you’d do if he’s right?

While I don’t know how far off Lepard’s prediction will end up being (if at all), I do know this: fiat currencies are trending to zero and that trend has accelerated in recent years. The good thing is, we have an escape hatch. An ark for the coming flood.

I fear the day of the next recession or depression, the day of reckoning that seems destined to come as a result of our reckless monetary policy. I fear it much less, personally, because of bitcoin.

However, I can't help but think about the damage that will be caused to people's livelihoods. Even if that day doesn't come in the next couple of years, that doesn't leave us without harm. High inflation continuing throughout 2022 will cause plenty of damage on its own: rising rent prices will kick people out of their homes, those saving for years in hopes of buying their first house will have to wait, lower-income families will find it more difficult just to put food on the table, those with disposable income will be encouraged to spend rather than save.

Inflation isn’t going anywhere. Not in 2022 and not anytime soon after. The thought that simply fixing supply chain issues will stop inflation in its tracks is naive at best. Even if that was the sole cause of the problem, the thought that deeply-rooted supply chain issues will be addressed in the short term is equally as naive.

All I know is that whether you're looking to hedge inflation, prepare for a monetary reset or simply opt out of a broken system, it’s a good thing we have bitcoin.

This is a guest post by Nick Fonseca. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

from Bitcoin Magazine: Bitcoin News, Articles, Charts, and Guides

Nick Fonseca

0 Comments